In the battle against check and ACH fraud, a Positive Pay system stands as an indispensable line of defense for financial institutions, providing robust fraud detection capabilities. By validating checks against a pre-approved list, it preemptively blocks unauthorized transactions, protecting your account holders and mitigating potential losses.

A Positive Pay System helps minimize the risk of check fraud ensuring that every customer’s check will clear before being deposited.

In this guide, we delve into the definition of Positive Pay. Read for insights for FI and cash management department leaders on how to leverage this often-overlooked fraud prevention tool.

What is Positive Pay?

Positive Pay is an automated cash management service designed to prevent check fraud by matching checks issued against those presented for payment. This system acts as a robust fraud protection measure for businesses and financial institutions, ensuring that only authorized checks are processed. By comparing the details of each check—such as the check number, dollar amount, and account number—against a pre-approved list, the Positive Pay system helps to identify and block unauthorized transactions. This proactive approach serves as a form of insurance against potential losses, fraud, and other liabilities, providing peace of mind and enhanced security for all parties involved.

How does Positive Pay work?

Positive Pay is a cash management and fraud prevention technique that matches checks issued, usually by a business, against those presented for payment, flagging discrepancies for verification.

So how does this system function in practical terms? Financial institutions use Positive Pay as an automated cash-management service to deter check fraud. The process involves comparing information from both parties to ensure that all checks being processed for payment are authorized, providing a reliable method of transaction verification. This approach serves as strong protection against any fraudulent activities surrounding counterfeit checks and strengthens overall financial security measures through its reliable functioning as part of banking services available today.

Types of Positive Pay

Positive Pay services come in various forms, each tailored to address specific fraud prevention needs:

Standard Positive Pay: This basic form of Positive Pay service matches the check number, dollar amount, and account number of each check presented against a list provided by the business. It ensures that only checks with matching details are processed.

Payee Positive Pay: An enhancement to the standard service, Payee Positive Pay includes the verification of the payee’s name against a pre-approved list provided by the account holder. This additional layer of protection helps prevent altered or washed checks from being cashed.

Reverse Positive Pay: In this approach, the business takes on the responsibility of monitoring its own checks. The business reviews checks presented for payment and alerts the bank to decline any unauthorized checks. This method requires a more hands-on approach but offers greater control over the verification process.

ACH Positive Pay: Designed to prevent fraudulent ACH transactions, ACH Positive Pay allows businesses to set filters or parameters for Automated Clearing House (ACH) transactions. These filters can include approved payee lists, transaction amount limits, and specific types of transactions. Any ACH debit or credit that does not match the established criteria is flagged for review.

- Read our ACH Positive Pay Guide here for more in-depth information.

An Example of Check Positive Pay

A simple example of Positive Pay in use would be a credit union providing a small business like a floral shop with the service. The floral shop owner would provide the credit union with a list of checks issued, including check numbers, amounts, and payee information. This list is then used by the credit union to verify checks presented for payment against the issued checks.

Any check not matching the provided details is flagged for review, and the floral shop owner is alerted to either approve or reject the payment within a certain timeframe ensuring that only authorized checks are processed and paid.

Positive Pay can extend to ACH transactions, offering businesses the ability to set rules and review incoming debits for unauthorized activity, thus enhancing electronic payment security.

Example: the shop owner may establish guidelines that only ACH debits from suppliers of flowers and floral accessories are permitted. That rule would prevent any unauthorized or fraudulent charges from unknown entities.

Additionally, the owner could specify a maximum transaction limit, providing an extra layer of control over the shop’s finances. This proactive approach to managing electronic payments fortifies the business’s defenses against increasingly sophisticated fraud tactics in the digital landscape.

Positive Pay Workflows: How They Operate

Curious about how this system works in more detail. Allow us to explain.

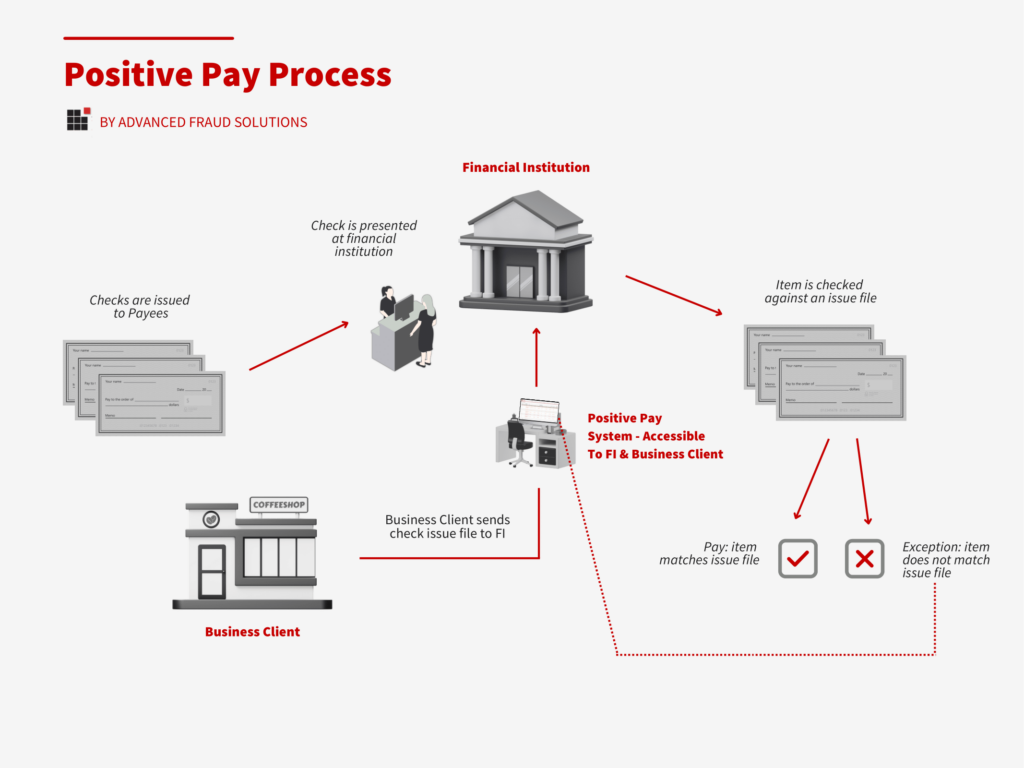

First, a business account issues checks. Next, that business generates a file containing all the necessary information about the issued checks. This file is then run through a Positive Pay system and sent to the financial institution for processing, helping to identify and block any fraudulent checks.

Exception Handling in Positive Pay

If a discrepancy is identified and the check details provided for payment do not match your records, your financial institution will take action. The bank notifies you by flagging the check, generating an exception report, and holding off on making any payments. You will then receive a notification through your online banking platform when the issue has been detected by the bank.

Essentially, this process resembles having an integrated alarm system within your financial institution that alerts you of anything suspicious or out-of-place in regards to checks presented for payment.

Automated Decision Rules

At this stage, the Positive Pay system leverages advanced, predetermined rules. A financial institution with Positive Pay enabled allows for the creation of automatic decision rules that dictate how exceptions are managed, for example, automatically declining checks exceeding specific criteria or amounts.

Even if there is only a slight error, such as forgetting to send a check list to the bank, the system can flag the check for review.

By automating this process, the check verification procedure becomes more efficient and only authorized transactions can be processed while reducing the need for manual review.

ACH Positive Pay Definition

Let’s do a baseline definition on ACH Positive Pay for financial institutions and business account holders. ACH Positive Pay is a fraud prevention service that enables FIs and businesses to set filters or parameters for Automated Clearing House (ACH) transactions. These could include such things as approved payee lists, transaction amount limits or entries for specific types of transaction.

When an ACH debit or credit comes through that does not match the established criteria, the item is flagged as an exception for the business to review and decide whether to pay or return before the item is processed. Implementing ACH Positive Pay is an important proactive step that both financial institutions and businesses can take in protecting themselves from unauthorized ACH or fraudulent activity.

ACH Positive Pay vs. Check Positive Pay

The difference between ACH Positive Pay and Check Positive Pay is that they provide deposit fraud protection for different types of financial transactions. ACH Positive Pay operates differently than Check Positive Pay. The process utilizes an approved vendor list for comparison and identification of any suspicious ACH pay activities.

ACH Positive Pay is designed for ACH-based transactions, offering financial institutions and business account holders a way to establish rules that operate in real-time about which transactions should be allowed, effectively preventing unauthorized transactions.

Check Positive Pay in contrast is for protecting against check fraud. This solution compares each check presented for payment against a file with a list of checks issued by the business.

ACH Credits and Debits

To better understand ACH credits and debits, let’s go back a bit. ACH credits are considered as ‘push’ transactions such as direct deposits or automatic bill payments, in which the sender initiates the transfer of funds from their bank account to another person’s account through the ACH network.

On the other hand, ACH debits are known as ‘pull’ transactions commonly used for regular expenses like utilities or insurance premiums. In this type of transaction, the recipient gives authorization to draw funds directly from the sender’s bank account through using the services provided by an intermediary – also known as the ‘ACH Network’.

ACH Positive Pay Workflow

So how exactly does the ACH Positive Pay workflow happen behind the scenes? The process involves the FI and the business account holder setting up guidelines based on the Originator of incoming debit transactions through ACH.

These rules provide business account holders with the opportunity to review all debits before they are processed by the financial institution, allowing for an informed decision to be made. It essentially acts as a security checkpoint for electronic payments, effectively stopping any potential fraud attempts from being successful.

An ACH Positive Pay Example

Let’s say one of your account holders is a thriving real estate company that manages numerous transactions daily, from property purchases to vendor payments. With an increase in electronic payments, the risk of unauthorized ACH transactions has become a concern for this business.

To address this, your treasury team collaborates with the the real estate business to implement ACH Positive Pay, aiming to bolster the security of their ACH transactions.

The real estate company works with their bank to implement ACH Positive Pay, focusing on securing electronic payments amid rising unauthorized ACH transaction concerns. They establish rules, like setting maximum payment thresholds and defining specific payment days for transactions. Approved ACH vendors include trusted property management software providers, construction firms for renovations, and utility companies for property maintenance.

Daily, the company reviews a list of pending transactions, authorizing those from their approved list and flagging others for review. This method sharply reduces fraud risk, streamlines payment processes, and enhances control over the company’s finances. Through ACH Positive Pay, the real estate company creates a strong safeguard against the potential of ACH fraud.

Reverse Positive Pay: An Alternative Approach

When you desire to take on more accountability for overseeing and confirming checks, Reverse Positive Pay becomes involved. With this method, the responsibility shifts onto your business to monitor any checks submitted for payment.

It involves a more active approach where you must be proactive and observant in order to ensure successful payments through pay verification.

Payee Positive Pay: An Additional Layer of Protection

We’ve explored various configurations and benefits of Positive Pay systems. But as check fraud continues to plague consumers and businesses daily, it becomes clear that ironclad protection extends beyond simply matching check numbers and amounts.

For an FI or businesses looking for the most advanced Positive Pay tech stack, Payee Positive Pay offers an additional layer of protection that is critical.

Payee Positive Pay Definition

Payee Positive Pay is an extension of the traditional Positive Pay service that includes the verification of the payee’s name against a pre-approved list provided by the account holder. This service is particularly vital in mitigating risks associated with altered or washed checks—where the name of the payee is fraudulently changed to divert funds.

By ensuring that the payee’s name on each check matches the information on the issued check list, FIs and their business clients can prevent unauthorized payments effectively. Note, Positive Pay by AFS includes Payee Positive Pay as part of its built-in feature set.

Implementing Positive Pay for Business Account Holders

For banks and credit unions looking to offer and implement Positive Pay for business account holders, here’s a very high level view of what needs to happen.

The business account holder must compile a check-issue file containing pertinent information such as date, dollar amount, account number and check number for each written business check.

In an ideal Positive Pay workflow, a business account holder should promptly update their check-issue record after writing checks to ensure precision and maximum effectiveness for fraud prevention processes.

In the case of ACH transactions, business account holders and FIs should work upfront to implement the ACH decisioning rules, and business holders should update those rules regularly as new criteria emerge.

It’s crucial for business account holders and financial institutions to work collaboratively ensure proper functioning of a Positive Pay implementation.

Positive Pay Service: Implementation and Management

Implementing a Positive Pay service involves several key steps to ensure effective fraud prevention. First, the business must enroll in a Positive Pay program offered by its financial institution. This typically involves providing a list of authorized checks, known as a Positive Pay file, to the financial institution. The bank then references this list before processing any submitted checks.

The financial institution may charge a setup fee and transactional fees for each check review. It’s crucial for the business to ensure that its accounting software is compatible with the Positive Pay system to facilitate seamless integration and accurate data submission. Regular communication and collaboration between the business and the financial institution are essential to maintain the effectiveness of the Positive Pay service.

Who Offers and Implements a Positive Pay System?

Typically it will be a financial institution’s treasury or cash management department, that will have the most involvement in offering and implementing Positive Pay for its business clients.

While Positive Pay integration may sound complex, there are providers that specialize in Positive Pay that enable FIs to offer the service to its business clients. These services, like Positive Pay by AFS have an intuitively designed interface allowing for convenient monitoring of exception items and uploading issue information related to cash management.

Advantages and Limitations of Positive Pay

Positive Pay, comes with its own set of advantages and disadvantages. One major benefit is its ability to provide considerable safeguard against fraudulent payments, thus potentially saving the business from significant monetary damages.

It does necessitate continuous monitoring of exception lists in order to prevent fraud and may also call for additional measures regarding data security during implementation.

Strengthened Fraud Protection

The main benefit of utilizing Positive Pay is its ability to enhance your defense against fraud for your FI and for your business account holders. By comparing issued check information with those presented for payment, it effectively blocks forged, altered, and fake checks from being paid out, thereby preventing fraudulent activity. ACH Positive Pay prevents unauthorized debits from a business owner’s account.

Differentiate Your FI with a Positive Pay Service

For a bank or credit union, having a Positive Pay software available as an offering has several advantages. First, it sets your FI apart and shows that you take fraud seriously. Offering a check and ACH Positive Pay option to business clients shows your level of commitment to not only protecting their financial assets but also to providing them with sophisticated tools to manage and control their funds.

By integrating this service, your institution demonstrates a proactive approach to security and a dedication to innovative solutions that enhance the banking experience for your clients. This can significantly boost the trust business customers place in your institution, potentially leading to increased customer loyalty and retention.

Additional Offering = More Revenue

Often, financial institutions will offer a Positive Pay solution as an add-on service to business account holders. Having this as an add on presents an opportunity for treasury departments to generate more revenue.

The revenue from Positive Pay usually comes through Business Process Outsourcing. While there are many ways it can be implemented and invoiced, FIs can ultimately choose to charge business account holders for the operation of Positive Pay on their behalf.

Considerations for FIs and Account Holders

Despite the obvious advantages of utilizing Positive Pay services, there are some factors that businesses should take into consideration for effective fraud prevention. They must establish and maintain strict internal controls for creating Positive Pay files and select a system that covers all possible check-cashing scenarios. They should be mindful of the limitations associated with these services as fraudulent checks may go undetected if payee names have been altered by fraudsters.

Positive Pay is an effective resource that provides substantial defense against fraudulent check and payment activities. Its strong authentication protocols and methods for managing irregularities make it a valuable asset to your organization’s financial strategies.

Positive Pay Fees and Cost Considerations

The cost of Positive Pay services can vary widely depending on the financial institution and the specific type of service offered. Some financial institutions may charge a setup fee, transactional fees, and integration fees, while others may offer the service for free or at a reduced rate as part of a broader package of financial services.

When considering the cost of Positive Pay, businesses should weigh the potential expenses against the significant benefits of fraud protection. The cost of implementing Positive Pay is often justified by the potential savings from preventing check fraud and avoiding the associated financial losses and liabilities. Businesses should also consider the long-term value of enhanced security and peace of mind.

Best Practices for Positive Pay

To maximize the effectiveness of a Positive Pay system and minimize the risk of check fraud, businesses should adhere to the following best practices:

Ensure Accurate and Timely Submission of Positive Pay Files: Regularly update and submit Positive Pay files to the financial institution to ensure that all issued checks are accurately recorded and verified.

Regularly Review Exception Reports: Promptly review exception reports generated by the Positive Pay system and take immediate action on any suspicious transactions to prevent unauthorized payments.

Implement Strict Internal Controls: Establish and maintain strict internal controls for creating and managing Positive Pay files to ensure data accuracy and integrity.

Select a Comprehensive System: Choose a Positive Pay system that covers all possible check-cashing scenarios and provides robust fraud protection features.

Provide Clear Information to the Financial Institution: Ensure that all check details provided to the financial institution are clear, concise, and accurate to facilitate effective verification.

Monitor and Adjust the System: Continuously monitor the Positive Pay system and make necessary adjustments to prevent false positives and false negatives, ensuring optimal performance and security.

By following these best practices, businesses can enhance the effectiveness of their Positive Pay system, providing a strong defense against check fraud and ensuring the security of their financial transactions.

Frequently Asked Questions

Is Positive Pay worth it?

Positive pay is a valuable investment as it serves as an efficient means of preventing fraud and detecting potential fraudulent transactions in advance. By implementing this tool, the risk of check alteration can be significantly reduced, resulting in more streamlined processes for safeguarding against fraud. In summary, positive pay offers various benefits related to combating financial crime and improving security measures surrounding payments.

What is the difference between Check Positive Pay and ACH Positive Pay?

Check Positive Pay and ACH Positive Pay differ in their purpose, with the former focused on detecting fraudulent checks and the latter designed for identifying potentially fraudulent ACH transactions. While Positive Pay relies on a list to compare checks, ACH positive pay uses filters as a means of intercepting suspicious payments.

Check Positive Pay requires an uploaded file for comparison. ACH Positive Pay is requires rules set up in advanced.

How Can a Check be Fraudulently Cashed Despite Using Positive Pay?

Many Positive Pay platforms prevent check fraud by comparing checks issued by a company with those presented for payment. However, there are limitations with that implementation and feature set. Some FI’s Positive Pay systems only validate check numbers, issue dates, and check amounts, not the name of the payee. This means if a check is altered to change the payee’s name—a technique known as “washing”—it might still be processed if the other details match the bank’s records.

For enhanced security, some Positive Pay platforms include Payee Postive Pay which specifically checks the payee’s name against a list provided by the business client. If there is a discrepancy in the payee’s name, the check is flagged, and the business client and their FI is notified for verification.

In the event of a check fraud incident where the check details were altered but went undetected by an implemented Positive Pay system, the business account holder should report the fraudulent activity immediately. The FI can investigate the matter further.

Example Case: An accounts payable worker at a large company noted that a check meant for a vendor was cashed by an unauthorized individual after the payee name was altered. Despite using Positive Pay, the discrepancy wasn’t flagged because their system did not validate against the payee’s name. This led to a fraudulent transaction that required the company to open a fraud case with their bank to address and resolve the issue.

Takeaway: While Positive Pay is a valuable tool for mitigating check fraud, it’s crucial for business clients to understand the specific features and limitations of their FI’s Positive Pay service. Businesses should ensure they opt for services that meet their security needs, such as Payee Positive Pay, to prevent such incidents effectively.

How much does Positive Pay cost?

The cost of Positive Pay will vary widely for an FI and for a business account holder. Often a Positive Pay solution is built into another software platform that an FI or credit union is already using like their core banking platform.

If an FI is offering Positive Pay as an add-on service to account holders, the price can be set by the institution.

What is a Positive Pay File

Here’s a general definition of a Positive Pay File. Within the Positive Pay process, when a business account holder writes checks, that person will then generate a list of those checks, including details like check number, account number, amount, and date. This list is referred to as the Positive Pay File, is then sent to their bank.

The financial institution that is managing the account holder’s Positive Pay service uses this file as a reference to verify checks presented for payment against the business’s issued checks. If a check matches the details in the file, it’s cleared by the FI; if not, it’s flagged for review by the business stakeholders. This process helps prevent unauthorized transactions, adding a layer of security to the check-clearing process.

What are the most common Positive Pay File types for financial institutions and business account holders to know?

Standard Positive Pay: This is the most basic form of Positive Pay service and file type. It requires businesses to send a file containing basic information about each check issued. The bank compares presented checks against this file for matching details.

Payee Positive Pay

An enhancement to the standard service, Payee Positive Pay also includes the payee’s name in the file sent to the bank. This allows for an additional layer of verification, as the bank checks not only the amount, date, and check number but also the payee’s name against the presented check.

Reverse Positive Pay

Unlike Standard or Payee Positive Pay, where the bank performs the verification, Reverse Positive Pay requires the business to do the verifying. The bank sends a list of presented checks to the business, which then reviews and approves each check for payment. It’s a more hands-on approach for businesses willing to take on the task of payment verification.

What file types should be prepared for Positive Pay file submissions?

When business account holders submit Positive Pay files to their financial institution, a few different file types may be used. Of course, this will depend on the Positive Pay Service the client is using. The FI will be able to guide business clients on the best file preparation. The choice often depends on the business account holder’s accounting software, the financial institution’s requirements, and the complexity of the check issue information.

CSV (Comma-Separated Values): A simple, text-only file, each record is on a line and the fields are separated by commas. Since most accounting software systems can easily generate this file format and it is so simple, it is widely supported.

TXT (Text File): Basic text files. The financial institution may require fixed-width format, where each field is a set number of characters, or delimited format, with delimiters other than commas, such as tabs or pipes.

Excel (XLS, XLSX): Some financial institutions accept Excel files, as many business account holders manage their finances using Excel, creating an Excel file for a Positive Pay submission may be more convenient. However, these are the least likely to be accepted, as there could be security issues with file types that can support macros.

BAI2 (Bank Administration Institute Format 2): Developed as a standard file for electronic communications between banks and their customers, used in bank statements and reconciliation. More likely a file might be preferred for business account holders with more involved banking.

XML (eXtensible Markup Language): Can define custom, highly complex data structures. A business account holder might prefer this file format if he has needs that standard file formats can’t meet. A financial institution might prefer to offer this for Positive Pay to offer very sophisticated services, as this file type is far more flexible than the fixed-width or delimited types.

NACHA (National Automated Clearing House Association) File Format: Mostly the format for ACH transactions, though a financial institution might want this for Positive Pay services for ACH items. Extensive experience with the file format through ACH transactions probably encourages its use through positive pay. Should discuss with the financial institution itself what file formats it supports, as well as how long certain Positive Pay services can be used on the file, and any required fields, field definitions and any field formats.

What is an exception in Positive Pay?

An instance of deviation in Positive Pay arises when there is a disparity between the check information submitted by the business account holder and that presented for payment, resulting in the bank generating an exception report and initiating exception management. The company will receive this report to notify them of any discrepancies found.

In the case of ACH Positive Pay, an exception occurs similarly when an ACH debit presented for payment does not align with the established filters or rules set by the business, such as those pertaining to the originator or amount thresholds. The bank will then issue an exception notification, prompting the business to review the transaction and decide whether to accept or reject the debited amount. This ensures that only authorized ACH transactions are processed, and any unauthorized or irregular activity is quickly brought to the business’s attention for immediate action.

The occurrence of mismatched details prompts the creation of an exception report by banks during transactions through Positive Pay. This leads to a delay or denial in payments as they investigate Notifying business account holders with their exception findings.