positive pay by afs

Secure more business accounts with Positive Pay — big bank security, without big bank pricing

Preventing fraud doesn’t have to be solely about stopping losses—it can unlock new non-interest revenue for your FI. Positive Pay can help secure cash flow while preventing fraud, ensuring that financial transactions are protected from bad actors and minimizing errors.

Strike a balance—grow non-interest income while fighting fraud

As a financial institution leader, you’re fighting the never-ending threat of ACH and check fraud while also working to grow your base of valuable business account holders. Every day, you try to navigate the demands of loss prevention, operational efficiency, and optimizing institutional revenue.

Plus, there is a heightened expectation to grow non-interest income streams, making a Positive Pay platform appealing. But implementing new systems can be expensive and time consuming for an FI.

the time is now

Don’t wait on a Positive Pay system

Demand for Positive Pay is on the rise

But the fact remains: while you’re weighing the pros and cons, your competitors are exploring Positive Pay solutions.

There is a growing interest in Positive Pay services among businesses and financial institutions as they seek to verify payees, understand associated fees, and leverage these services as a fraud safeguard.

Fraud is only getting worse

And fraudsters—they’re not waiting around. Every day they find new paths to break into business accounts, yours included.

To combat this, checks presented for payment are verified against a list provided by the company to detect fraud and prevent unauthorized or fraudulent checks from being cleared.

Non-interest income is on the decline

Non-interest income is at risk as fintechs, big techs, and neobanks recalibrate account holders’ tolerance for traditional fee structures.

Introducing Positive Pay by AFS

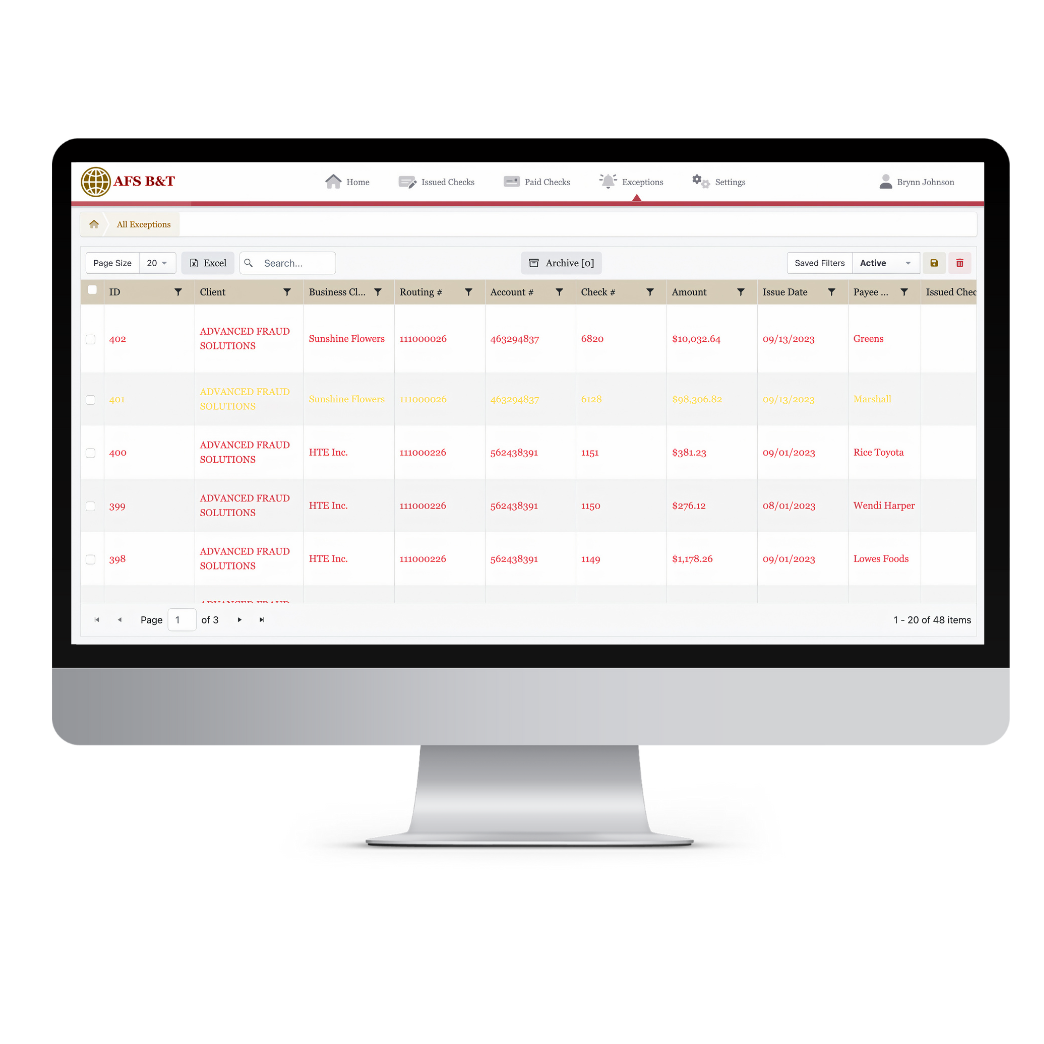

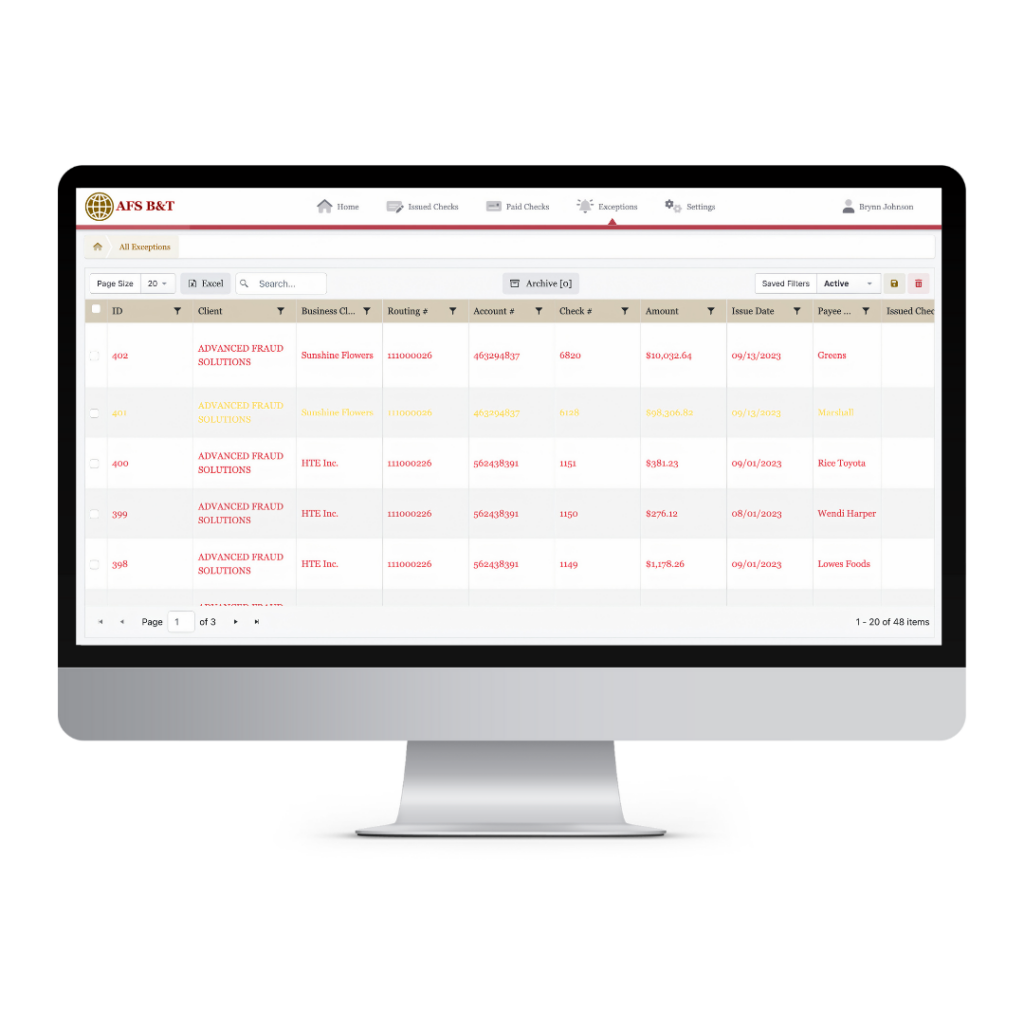

Positive Pay by AFS isn’t just another deposit fraud tool; it’s a cash management offering that can set your FI apart from the competition. A Positive Pay file is provided by the business client to the financial institution, listing all checks written, which the FI uses to verify each check number and dollar amount. When discrepancies are found, an exception report is generated, notifying the customer and withholding payment until the company advises the bank to accept or reject the check. For FIs with an existing Positive Pay solution, our check and ACH Positive Pay technology is the most modern, user-friendly platform available. With our competitive pricing, our Positive Pay is an approachable option for FIs looking to confidently attract more business accounts.

Traditional Verification

Check Positive Pay

Ensures secure transactions by matching issued checks against a predetermined list, including details such as check number, account number, and dollar amount.

Rule Based Security

ACH Positive Pay

Allows account holders to set specific rules for transactions, offering customized security.

Merchant/Vendor Driven Review

Reverse Positive Pay

Gives control to account holders to approve or deny transactions without an issue file.

DIVE RIGHT IN

Made for usability

Our user-friendly interface allows both FIs and business clients to be up and running in minutes.

TAILOR YOUR EXPERIENCE

Built for your brand

Customize your dashboard settings down to logos, color schemes, and alerts for consistency across devices.

OPTIMIZE OPERATIONS

Configured for choice

Set your own transaction guidelines, choose from multiple data input options, and manage role-based permissions.

Positive Pay FAQs for Financial Institutions

How does Positive Pay fraud protection safeguard businesses and financial institutions against unauthorized transactions?

Positive Pay is a fraud prevention mechanism designed to protect businesses and financial institutions from unauthorized transactions, specifically targeting check and ACH payment fraud. The system operates through a rigorous verification process:

- Issue File: Business account holders with access to a Positive Pay service submit a detailed list of issued checks to their FI, including check numbers, payment amounts, and payee names.

- Transaction Verification: Upon presentation of a check for payment, the FI cross-references it with the issue file. Any discrepancy in the details triggers an exception, prompting the business account holder to review the transaction for potential fraud or validity. Positive Pay work involves matching check details such as date, check number, dollar amount, and account number, and handling any discrepancies by flagging them for review.

- ACH Transaction Controls: Beyond traditional checks, ACH Positive Pay also exists. Business account holders can define specific parameters, including authorized payee lists and transaction value limits, to safeguard against unauthorized ACH payments.