The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), a $2 trillion relief package to cushion the economic impacts of COVID-19, will be a windfall for U.S. businesses and consumer alike. The stimulus package will also bring about a historic volume of deposits in a relatively short period. As a result, higher deposit volume means more check fraud attempts.

Banks and credit unions across the U.S. are preparing accordingly, including shoring-up their front line defenses for what is likely to be a massive spike in fraudulent activity.

More Unemployment, More CARES Act Fraud.

With a 3,000% jump in jobless claims in a one-week period (bringing the total to 6.65 million), U.S. citizens are rightfully in need. Unfortunately, financial crises are directly correlated with an increase in fraud activity – the U.S. saw a similar spike in 2008.

Multiple news outlets have reported that fraudsters are already putting their plans into motion. Excluding the high levels of fraud activity that have already resulted due to the COVID-19 panic (including business email compromise schemes, fake e-commerce sites, etc.), the main thrust of this latest wave of fraud activity will be around the CARES Act recovery rebates for individuals.

According to the CARES Act bill, U.S. taxpayers are eligible for a deposit of $1,200. Married couples could get $2,400, plus an additional $500 per child. These payments will be delivered in two ways: direct deposit and Treasury checks.

Treasury Checks, a Dangerous Deposit Fraud Tactic

When it comes to Treasury checks, Advanced Fraud Solutions, the leader in deposit fraud detection, recommends financial institutions be on the lookout for the following deposit fraud tactics. Here are three recommendations to prevent deposit fraud:

1. Treasury Check social engineering schemes

The U.S. Department of the Treasury issued a warning regarding social engineering schemes, stating: “If you receive calls, emails, or other communications claiming to be from the Treasury Department and offering COVID-19 related grants or stimulus payments in exchange for personal financial information, or an advance fee, or charge of any kind, including the purchase of gift cards, please do not respond. These are scams.” According to reports, fraudsters are already using Treasury checks as a way to leverage victims for information and/or payment.

2. Duplicate deposits

A low-effort, easy to execute method of defrauding banks and credit unions will be via duplicate deposits, particularly using mobile and RDC channels. The fraudster simply deposits the Treasury check at multiple financial institutions and withdraws funds from multiple financial institutions before the victim realizes they were scammed.

3. Counterfeit Treasury checks

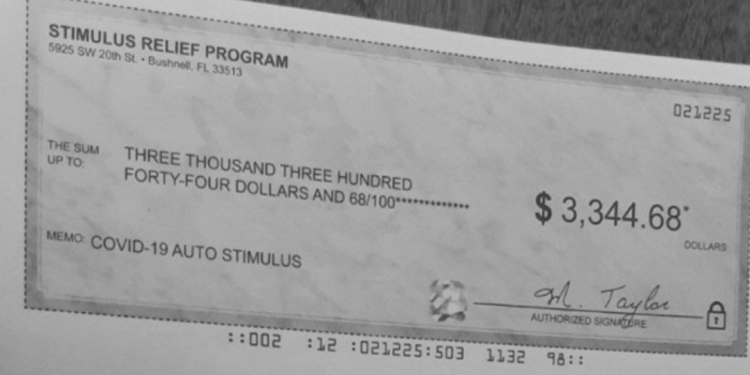

Today’s fraudsters have the printing and scanning technology to produce passable counterfeit checks en masse on high-quality, watermarked check stock. Because these fake checks will originate from one place – the U.S. Department of the Treasury – the process for producing these items will be accelerated. For example, the fraud operator doesn’t have to bother with creating multiple check copies from different financial institutions. Some counterfeit items will be easy to spot. For example, as seen in the image below, if the Treasury items includes cents, it’s fraudulent. Other items will not be so easy to spot.

U.S. Treasury Check Fraud Prevention Strategies

More alarming, most banks and credit unions today are at an even greater risk as deposit limits have been extended. This extension makes it easier for legitimate consumers to bank remotely, pay rent, etc. What is more, although banks and credit unions have been deemed essential businesses, branches across the U.S. have either drastically reduced staff or temporarily closed. This is a reality for which most financial institutions are not well-equipped. This includes the processes in place to handle an uptick in fraud activity, working remotely or with a skeleton crew.

To handle what’s to come, and ensure an effective check fraud prevention strategy, financial institutions need to focus on fortifying every point of presentment. Fraud operators will seek out the weakest point and exploit it. An omnichannel approach is essential.

Fraud operators will also take advantage of the massive influx of items that financial institutions will be required to process. This requires a real-time approach that preferably links directly to the Treasury.

TrueChecks®, a comprehensive check fraud prevention solution, links directly to U.S. Treasury

TrueChecks®, a leading comprehensive check fraud prevention solution from Advanced Fraud Solutions, delivers such an approach. TrueChecks links directly to the Treasury as well as displays Regulation CC-recommended actions and associated risk at the moment of presentment. This allows even inexperienced tellers to make the right call before exposing your financial institution to risk.

TrueChecks evaluates deposits across deposit channels by scanning check data against the TrueChecks database, which features over 10 years of historical data from thousands of banks, credit unions, and processor sources.

Seamlessly integrating into any existing system, TrueChecks offers real-time responses on duplicates (effective against double presentment ploys), counterfeits, non-sufficient funds (NSF), and closed accounts. This helps reduce manual workload, manager intervention and check fraud losses.