The Practical Guide to US Treasury Check Verification and Fraud Prevention

While all financial institutions have access to TCVS, how you integrate it into your fraud prevention process makes a difference. The Treasury Check Information System (TCIS) accesses data related to U.S. Treasury checks and Automated Clearing House (ACH) payments, providing a comprehensive dashboard for managing payment data. Here are the primary ways to access TCVS and how they impact efficiency, fraud detection, and operational workload.

- Direct Access Via the TCVS Public Website

- Secure API Access to TCVS

- Through a TCVS-Integrated Fraud Prevention Solution

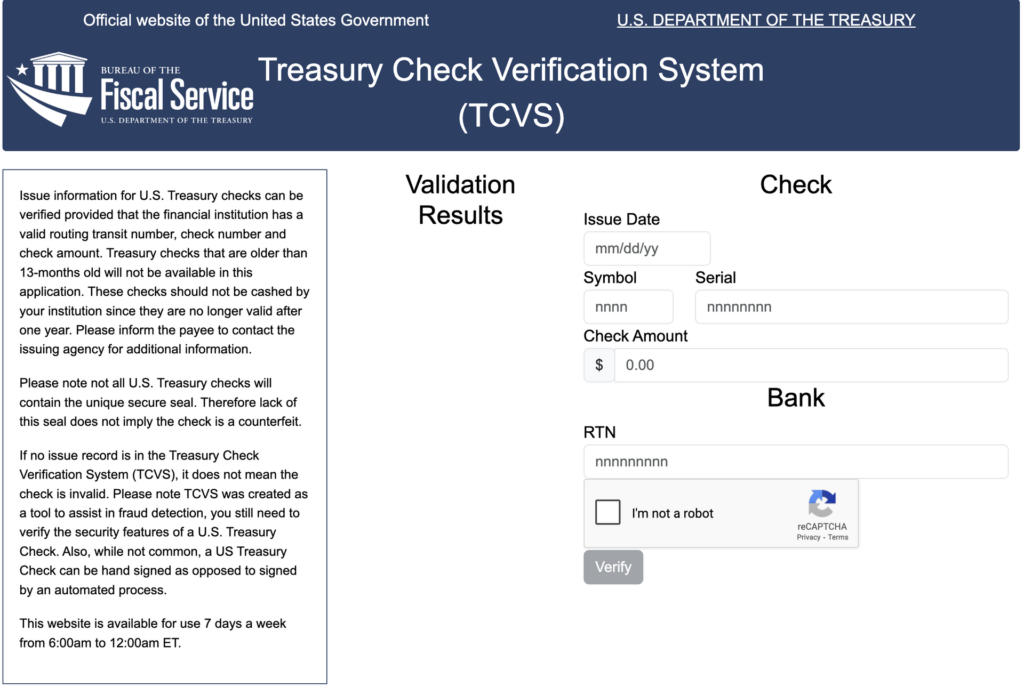

1. Direct Access via the Treasury Check Verification System (TCVS) Public Website

The most basic way to verify a Treasury check is through the Treasury’s public-facing TCVS website. This free tool allows financial institutions to manually enter check details—such as the check symbol, serial number, date, valid routing transit number, and payment amount—to confirm authenticity.

Best For: Institutions that process a low volume of Treasury checks and don’t require automation.

Challenges:

- Manual entry of checks into the TCVS system is a resource-drain for teams handling high check volumes.

- Payee validation is not available on the public website. Institutions using this method can only verify check details, not confirm the payee.

- Slower processing times increase the risk of fraud slipping through before verification is complete.

2. Secure API Access to TCVS

For financial institutions that require automated, real-time verification, the TCVS API is the best option. The API version of TCVS is the only way to access the crucial payee validation feature, which verifies that the payee name on the check matches Treasury records.

Best For: Financial institutions that need automated fraud detection and minimal manual intervention.

Challenges:

- Requires an application process through the Treasury, which can take several weeks for approval.

- API access requires secure credentials (keys) issued by the Treasury.

- Implementation requires skilled IT resources to integrate with fraud prevention workflows.

A Note on Scaling Treasury Check Verification for High-Volume Institutions

Treasury check processing volumes vary widely, but larger financial institutions process significantly more than smaller ones.

- In 2020, the median Treasury checks processed per small FI (under $600M in assets) was ~2,974 per year (Federal Register).

- The total Treasury check volume in 2020 was ~83 million checks (Federal Reserve).

- Based on industry data, larger FIs handle tens of thousands of Treasury checks annually.

The Treasury Check Information System (TCIS) provides vital information regarding U.S. Treasury checks and associated payment data, supporting post-payment activities and facilitating check verification.

How We Calculated This:

- We took Federal Reserve-reported check volume (83M checks in 2020).

- We used a dataset of 200 smaller institutions to find the median (~3,000 checks per FI per year) (Federal Register).

- The total number of banks and credit unions in the U.S. (~9,300 FIs) was sourced from FDIC and NCUA reports.

- We extrapolated Treasury check volume by institution size, confirming that large FIs process exponentially more Treasury checks than smaller ones.

Why This Matters:

- For high-volume institutions, manual verification is inefficient. Treasury checks must be verified in real-time to prevent fraud.

- Without an automated TCVS solution, fraud risk increases due to processing delays and operational bottlenecks.

- API-based integration is the only way to access payee validation—making it essential for FIs handling high check volumes.

3. Accessing TCVS Through a Fraud Prevention Solution

The most efficient way for financial institutions to access the full benefit of TCVS features is through a TCVS-integrated fraud prevention solution with API-based access.

Best For: Institutions looking to automate Treasury check verification without dealing with direct API integration challenges.

Advantages of Using a TCVS-Integrated Solution:

Automated TCVS Fraud Prevention – Eliminates the need for tellers, back office, and other FI staff to access the TCVS system in an ad hoc, time-consuming way.

Payee Validation without the Tech Hassle – Ability to validate Treasury check payee information without direct Treasury API setup at the expense of your own tech team’s time and resources.

Integration With Core Systems – Some TCVS-integrated fraud solutions connect with other partner systems, helping optimize operations even further.

Faster Implementation – Avoids the time-consuming process of applying for direct API credentials.

TrueChecks is one of the only fraud prevention solutions that integrates real-time TCVS API access with payee validation, making Treasury check fraud prevention faster and more effective.

| Access Method | Payee Validation | Automation | Implementation Time | Integration Required | Best For |

| Public Website | ❌ Not Available | ❌ Manual Entry Required | ✅ Immediate Access | ❌ No Integration | Low-volume, manual verification |

| Direct API Access | ✅ Available via API |

✅ Full Automation (Requires IT Integration) | ❌ Requires Treasury Approval (Weeks) | ✅ Requires IT & API Setup |

Institutions with IT resources for API integration |

| TCVS-Integrated Solution (TrueChecks) | ✅ Available via API |

✅ Fully Automated via Partner Platform | ✅ Implement with Support via Partner | ✅ Seamless Integration with Existing Systems | FIs wanting automation without API setup hassle |

How to Choose the Right TCVS-Integrated Provider

Not all TCVS-integrated fraud prevention solutions offer the same level of security, efficiency, or ease of use. Here’s how to evaluate providers:

1. Integration with Your Existing Systems

A solution is only as good as its ability to fit into your existing workflows. The best providers offer:

Pre-built integrations with major banking and fraud prevention platforms

Flexible APIs that work with different FI tech stacks

Tip: Advanced Fraud Solutions partners with many of the top financial technology providers. See our list of partners here.

2. Comprehensive, Real-Time Check Fraud Prevention

If you’re evaluating a Treasury check fraud prevention solution, you should ensure it also protects against all types of check fraud—not just Treasury checks. Fraud schemes evolve, and check fraud losses often come from forged, counterfeit, or altered checks across all deposit channels. The best solution will:

- Prevent fraud in real time at the point of presentment – teller line, ATM, ITM, and batch deposits

- Leverage a vast, consortium-powered fraud database to detect patterns of altered, counterfeit, and stolen checks

A solution that only verifies Treasury checks but lacks full check fraud detection leaves your FI vulnerable to losses. Make sure the provider you choose delivers end-to-end, omnichannel check fraud prevention.

3. Experience, Agility, and Strong Partnerships

Choosing the right fraud prevention partner goes beyond technology. You want a company that:

- Has a long-standing relationship with the U.S. Treasury and deep experience with TCVS

- Moves fast to adapt to evolving fraud tactics

- Maintains strong industry partnerships to integrate seamlessly with your existing tech

Highlight: Advanced Fraud Solutions has worked with the Treasury for years and was one of the first providers online with the Payee Validation feature of TCVS. Our long-standing expertise ensures FIs get a solution that is proven, secure, and constantly evolving to stay ahead of fraud.

You came here to figure out the best way to integrate Treasury Check Verification System (TCVS) fraud prevention into your financial institution’s workflow. Now, you know the options and what to look for in a provider.

If you’re investing in Treasury check fraud prevention, it makes sense to choose a solution that protects against all types of check fraud. Fraud happens at the teller line, ATM, ITM, and in batch deposits. It moves fast. The best solutions catch it in real time before losses happen.

So, here’s what to ask yourself: Does my institution have a solution that prevents all types of check fraud, right at the point of presentment?

If you’re not sure, now’s the time to explore what TrueChecks with TCVS access and Payee Validation can do.

Let’s stop Treasury check fraud. See a live walkthrough of our TCVS enabled solution.

FAQs

What are the Key Features of a Valid Treasury Check?

Here are some of the key identifiers of a valid treasury check.

- Verifying the Treasury Seal: Always check for the Treasury Seal, which should read “Bureau of the Fiscal Service.” This seal is a critical indicator of a legitimate Treasury check.

- Checking for Watermarks: Hold the check up to a light source to verify the watermark, which should read “U.S. TREASURY.” This watermark is embedded in the paper and is a key security feature.

- Ultraviolet Overprinting: Use a UV light to verify the protective ultraviolet (UV) pattern. This pattern consists of lines of “FMS” bracketed by the FMS seal on the left and the U.S. Seal (eagle) on the right, providing an additional layer of security.

- Checking for Security Threads: Verify the presence of security threads, which are embedded in the paper and glow under UV light. These threads are another crucial element in detecting counterfeit checks.

- Using the Treasury Check Verification System (TCVS): Financial institutions can leverage the TCVS to verify the authenticity of U.S. Treasury checks. The TCVS provides a reliable method for confirming check details and preventing fraud.

By incorporating these advanced fraud prevention strategies, financial institutions can significantly reduce the risk of accepting fraudulent Treasury checks.

| Check Description: | MICR Line: |

|---|---|

| Where information is located | Magnetic Ink Character Recognition Line |

| 1. Issue Date | A. Check Symbol |

| 2. Payee Name | B. Check Digit |

| 3. Disbursing Office Location (Optional) | C. Routing Number Unique to U. S. Treasury checks |

| 4. Issue Type | D. Check Serial Number |

| 5. Check Symbol | E. Check Digit |

| 6. Check Serial Number | F. Federal Entity Code |

| 7. Issue Amount | G. Issue Date (MM/YY) |

| H. Paid Amount, if the financial institution encodes the amount |

What Treasury Check Resources and Assistance are Available?

For assistance with U.S. Treasury checks, FIs can contact the following resources. These resources provide valuable support for various issues related to Treasury checks, ensuring that you have the help you need when you need it.

- IT Service Desk: For technical issues related to the Treasury Check Verification System (TCVS), contact the IT Service Desk at 304-480-7777. They provide technical support to ensure the smooth operation of the TCVS.

- Payment Management Call Center: For help with Treasury check verification and other payment-related issues, call the Payment Management Call Center at 855-868-0151, option 1. This center provides direct support for verifying checks and resolving payment concerns.

- Internal Revenue Service (IRS): Contact the IRS for assistance with tax-related issues, including refund payments. The internal revenue service can provide guidance on matters related to tax refunds and other Treasury payments.

- Fiscal Service: For assistance with Treasury check verification and other payment-related issues, contact the Fiscal Service. They offer support for verifying checks and addressing payment discrepancies.

- Federal Reserve Banks: Reach out to the Federal Reserve Bank for help with Treasury check verification and other payment-related issues. The Federal Reserve Banks play a crucial role in the processing and verification of Treasury checks.

- Social Security Administration: For assistance with federal benefits, including pay federal benefits, contact the Social Security Administration. They can help with issues related to Social Security payments and other federal benefits.

- Secret Service: If you encounter counterfeit Treasury checks, contact the Secret Service. They specialize in investigating and addressing counterfeit check issues.